Companies strive to be capital-efficient by maintaining low inventories. However, the costs associated with only aiming for lower inventories might not be obvious at first sight. A simple example includes ordering few items very frequently, with the effect of not benefiting from quantity discounts. To achieve the goal of overall profitability and efficiency, a Total Cost of Ownership (TCO) approach can help. In this article, we go deeply into how TCO can be used to make the right decisions on “when to order how much inbound materials for production”.

What is the Total Cost of Ownership (TCO)?

The TCO concept as we know it today has been around for decades, initially emerging from the need to account for the entire life cycle costs of PCs. In its broadest sense, the TCO is the value obtained from the financial analysis of a capital purchase or investment, such as a product or system, across its entire life-cycle. This includes accounting for every direct and indirect cost across acquisition, operation, and replacement.

TCO is very versatile in that it can be applied across numerous contexts and industries, specifically when it comes to benchmarking and making decisions where trade-offs are involved. Let’s take the simple example of purchasing a new personal vehicle. In choosing between two vehicles, while one of the vehicles may have a higher purchase price, its lower maintenance costs and insurance fees as well as greater energy efficiency and resell value may result in a lower TCO. Evidently, there are many more cost-drivers and hidden costs associated with such a purchase than just purchase price. When it comes to ordering inbound materials it is no different.

Making things even more complex is the fact that not all cost-drivers and cost-savings are equal or often treated equally. On one hand, some cost savings may be very tangible (i.e. realized discounts), having a direct impact on the bottom line by reducing or avoiding an existing cost; these are often described as ‘hard’ or ‘green’ savings as well. However, other cost savings may be intangible, and difficult to measure or to attach a financial value (i.e. time gained by an employee); they are also known as ‘soft’ or ‘blue’ savings.

Due to this complexity, a TCO model that works for one company or for one product will not necessarily work for a different company or product.

TCO and Lot Sizing

With the emergence of the lean movement came just-in-time (JIT) inventory. In just-in-time inventory the goal is to minimize the carrying cost, increase efficiency and reduce waste. Nevertheless, it may undermine the costs associated with placing an increased number of orders, ignoring the potential cost savings from quantity discounts and bulk ordering and failing to consider unpredictable supply chain disruptions as we discuss in another one of our articles.

On the other hand, bulk ordering also has its setbacks as it ties additional working capital and carries other risks associated with it such as scrap. Somewhere in the middle of these two policies we can find the optimal order quantity that minimizes the total cost of purchasing.

Minimizing the TCO means achieving the right balance between the purchase price and purchase quantities, the ‘order cost’ defined as the cost for placing an order and the inventory carrying cost also known as the ‘inventory holding cost’. We can thus define the Total Cost of Ownership as follows:

TCO = Purchasing Cost + Order Cost + Carrying Cost + Cost of Scrap

In order to optimize this formula it is necessary to first understand the components that go into each one of these costs by answering the four following questions:

- What are my purchasing cost-drivers?

- What are my order cost-drivers?

- What are my carrying cost-drivers?

- What is my cost for scrap?

What are my purchasing cost-drivers?

In many cases the purchasing or material cost itself will be the largest cost-driver. This cost is simply calculated by the price of the material times the quantity purchased.

In some cases the purchase price is not necessarily fixed, as it may be influenced by the order quantity in the form of quantity discounts as well as by the changing market conditions such as disturbances (i.e. natural, political, etc.), seasonality, or other factors (i.e. speculation) influencing the supply and demand of inbound materials. There are additional constraints on the quantities that can be ordered including minimum order quantities, maximum order quantities, and rounding values, often determined in negotiations with the suppliers by the strategic sourcing department.

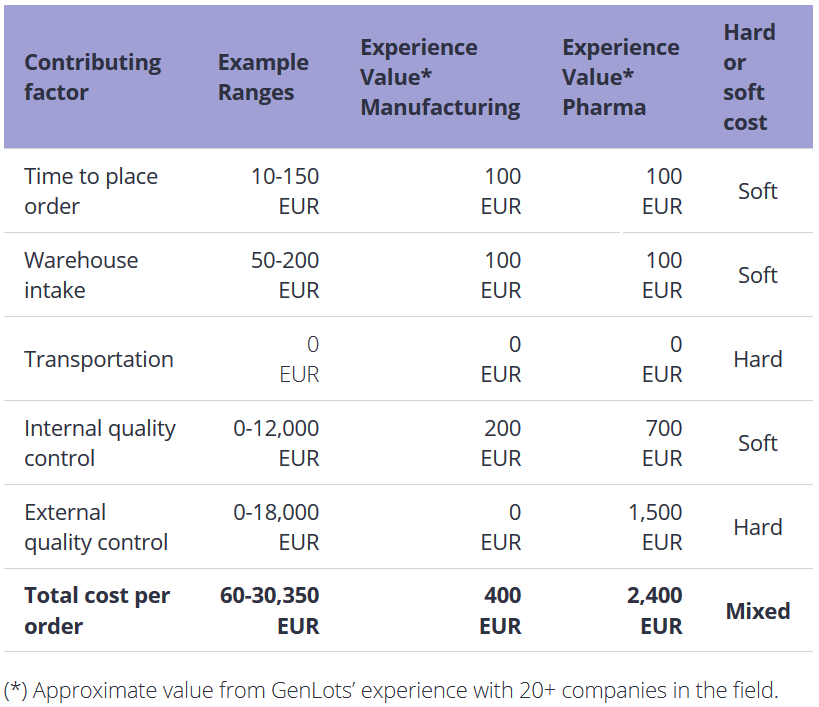

What are my ordering cost-drivers?

Ordering costs are generally independent of the quantity ordered and can be broken down into three elements:

1. The ordering process itself

The ordering process consists of the time spent to place and manage each order. This may include activities such as calling, negotiating, preparing the purchase requisition, preparing the purchase order, processing the invoice, and issuing the payment.

2. Transportation

In some cases, transportation may already be baked into the price of the material, being paid for by the supplier and reflected in the quantity discounts. However, depending on the Incoterms the cost may not be or may partially be paid by the supplier. In such cases, it is important to understand what your approximate cost per order is. Other factors such as the required lead time and transportation mode can play an important role, resulting in additional expenses, reduced service levels, or even stopped production.

3. Handling of goods upon arrival

When materials arrive on-site additional labor costs are incurred to process and put away each order at the warehouse. For certain industries, each time an order is received, a costly quality control process (we saw up to 20’000 EUR per quality control and order in the wild) may be required (i.e. chemical identity, content, purity, microbiology). Such a process may take place internally or externally and its cost may be variable or fixed regardless of the quantity delivered. On low order value orders, quality control costs can often represent the largest cost component, and hence bundling can offer a large savings opportunity.

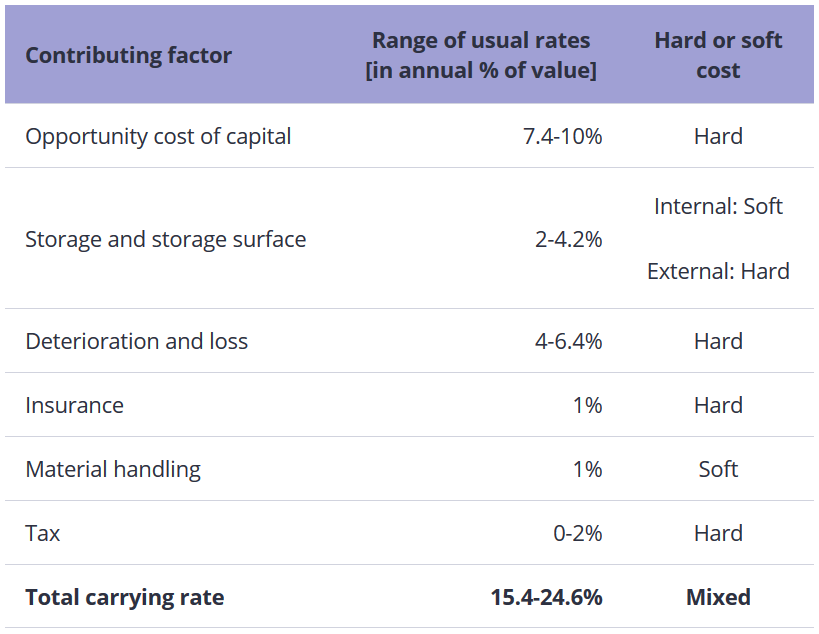

What are my carrying cost-drivers?

The cost of carrying inventory is the cost of holding or storing an item for a period of time, no matter whether this takes place internally or externally with a third-party service provider. This cost can be expressed as a fraction of the inventory value (i.e. purchasing cost). Below is a list followed by a description of the main factors influencing carrying costs and the respective ranges of reasonable rates for each according to Fierz (2009) and Steinle (1984). 2,3

1. Opportunity cost of capital

The opportunity cost of capital is the minimum rate of return expected from investing the same capital into a different project or doing nothing. In some cases it can be the interest rate that a company pays to obtain its capital. While banks want to earn interest on their loans, shareholders expect to earn dividends or capital gains on their shares.

This “interest” or opportunity cost of capital is calculated using the Weighted Average Cost of Capital (WACC), which is generally a well-known number internally in any company. When investing capital into inventory, this inventory does not generate a concrete return, but it does lead to paying interest on the inventory’s value. This is the main reason why companies try to hold low inventories: to increase free cash flows.

2. Storage and storage surface

Often this involves a mix between externally rented (hard cost) and internal storage space (soft cost). Both alternatives also require extensive human resources, physical equipment, and software applications to manage and maintain the operation.

3. Deterioration and loss

Holding more inventory means automatically having also a higher potential loss through deterioration or unplanned obsolescence; that is why this cost is often expressed as a percentage of inventory value.

4. Insurance

The more inventory you hold, the higher the price that is paid for insuring this inventory against an adverse event like a warehouse on fire.

5. Material Handling

With higher inventory comes more work associated with tracking, displacing, and moving inventory.

6. Tax

Taxes paid on the value of your inventory might also contribute towards the carrying cost. They are calculated as a percentage, varying by country or region, on the value of the unsold inventory at the end of the financial year and their value may be obtained using different methods.

What is the cost of scrap?

Scrap is the easiest of the four factors to understand, as in many cases, it is simply the purchase price of the material that is being scrapped. However, it can get tricky in some cases, such as when there is a need to dispose of dangerous chemicals, which can be a costly process in itself.

Making the optimal decision

In the context of order planning and lot sizing, an often used method in combination is the economic order quantity (EOQ), also known as Andler’s Formula in Germany and Wilson’s Formula in France. Although GenLots does not specifically implement EOQ, which recommends a static lot size, it does use the same underlying concepts. EOQ was developed in 1913 by Ford W. Harris in order to mathematically compute how much to buy based on a static average inventory, order cost, and carrying cost. Unfortunately, EOQ ignores many of the real-world considerations and is difficult to adapt for incorporating new parameters and constraints.

Despite its many shortcomings, this model is still widely taught in universities and applied across many companies due to its relative simplicity. A true TCO analysis will also consider demand forecasts, consumption patterns, changing costs associated with different purchase quantities, asset utilization and capacities, as well as risk in all its forms (i.e. disruptions, obsolescence, etc.). Although newer models have come after this one to capture some of these variables and constraints, until GenLots came along, there was no heuristic available, which takes into account all constraints and can be easily applied to different industries.

Present-day ERP systems deliver some optimization, but few if any follow a TCO approach. This is exactly GenLots’ promise in filling in this gap. GenLots’ algorithm based on reinforcement learning flexibly captures all of these parameters and constraints to deliver individually customized order plans for thousands of products at a time.

In times of crisis as we have seen during the current COVID-19 one, the trade-offs between being capital-efficient and increasing one’s risk exposure from disruption, such as longer lead times or uncertain supply, remarkably increase in scale. TCO has proven to be a robust concept in factoring in those variables in changing times. It has also proven to be very extensible; in collaboration with EPFL, we are currently evaluating the potential incorporation of CO2 emissions into our total cost approach, making companies more sustainable in an automated, profit-oriented way.

About GenLots

GenLots is a SaaS provider from Switzerland that uses machine learning to optimize supply chain processes. Their core technology, the Artificial Supply Chain Brain, imports real world data from an ERP to improve purchasing plans by decreasing order transactions and reducing inventory. Implementations with major industrial companies (like Merck) successfully reduced total purchasing cost by up to 10%

Footnotes

Silver, E.A., Pyke, D.F. & Peterson, R., 1998. Inventory Management and Production Planning and Scheduling 3rd ed., John Wiley & Sons.

Fierz, A., 2009. Konsignationslager: Ausgangslage, Ziele und Konzeption zur Umsetzung. Available at: http://ipek.hsr.ch/fileadmin/user_upload/ipek.hsr.ch/Newsroom/events/2009/0911_innovationstagung/Fierz_Konsignationslager.pdf

Steinle, J.G., 1984. How to Decide on the Best Quantities to Order of a Particular Item—In the O.R., C.S., Emergency Room, Materials Management. Hospital Topics, 62(5), pp.46–49.

Written by Andres Engels, Project Manager at GenLots as well as a master thesis student in Management, Technology, and Entrepreneurship at EPFL in Lausanne, Switzerland.